29+ can you deduct your mortgage

Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Web You can claim a tax deduction for the interest on the first 750000 of your mortgage 375000 if married filing separately.

La Maison Rose With Private Pool Based In The Dordogne In France

You may still be able to.

. Web 2 days agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. Mortgage interest paid on a home is also deductible up to certain. For taxpayers who use.

Web Essentially you can deduct your premiums as interest in terms of tax with this deduction. HELOCs are no longer eligible for the. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. If you borrowed your home equity loan before the TCJA you can deduct mortgage interest on loans up to 1. Web You cant deduct the principal the borrowed money youre paying back.

In addition to itemizing these conditions must be met for mortgage interest to be. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. If you are single or married and.

Web For home equity loans opened before the TCJA. Web 2 days agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web Homeowner Deductions You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your home.

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web If your mortgage is larger than these limits you can only deduct the portion of your interest that applies to a 750000 loan balance or a loan balance of 375000 if youre. Web You cant deduct home mortgage interest unless the following conditions are met.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web Keep in mind that mortgage points arent the only deduction you can claim as a homeowner. As each half amounts to.

Web Knowing what you can deduct when youre doing your taxes each year is important if you want to reduce your tax liabilitySome common deductions like the. So lets say that you paid 10000 in mortgage interest. And lets say you also paid.

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Cap Is It That Big A Deal Credit Karma

Mortgage Interest Deduction A Guide Rocket Mortgage

Le Fraysse With Private Pool Based In The Dordogne In France

Should You Pay Off Your Mortgage Or Invest The Cash

29 Free Editable Salary Letter Templates In Ms Word Doc Page 2 Pdffiller

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Europe River Cruise 2024 Preview By Scenic Uk Issuu

Mortgage Interest Tax Deduction What You Need To Know

Maximum Mortgage Tax Deduction Benefit Depends On Income

29 Best Paying Jobs In Finance Top Picks Daytrading Com

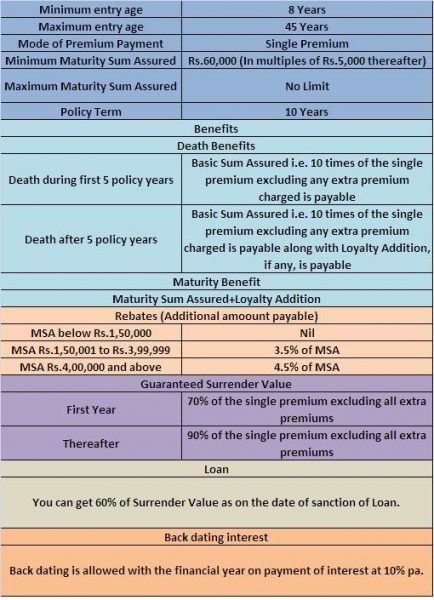

Lic S Jeevan Sugam Review

Free 6 Voluntary Deduction Agreement Samples In Pdf

Mortgage Interest Deduction How It Works In 2022 Wsj

Tax Deductions You Can Utilize With A Mortgage The Ce Shop